How much will it cost us to restore public higher education in 2011-12?

This post has been superseded by updated versions:

How much will it cost us to restore public higher education in 2012-13?

How much will it cost us to restore public higher education in 2013-14?

Raising revenue has become such a taboo subject in California politics, but restoring quality public higher education in California can be done. For the median California tax return (individual or joint), restoring the entire system while rolling back student fees to what they were a decade ago would cost $49 next April 15.

Read “Financial Options for Restoring Quality and Access to Public Higher Education in California” below or download a PDF of it (October 2011, 8 pp.) If you’re really a policy wonk, download the spreadsheets behind this report.

540 Calculator: What restoring the system will cost you.

WORKING PAPER

FINANCIAL OPTIONS FOR RESTORING QUALITY AND ACCESS TO PUBLIC HIGHER EDUCATION IN CALIFORNIA: 2011-12

Stanton A. Glantz

Professor of Medicine

American Legacy Foundation Distinguished Professor in Tobacco Control

University of California San Francisco

Chair, University of California Systemwide Committee on Planning and Budget (2005-6)

Vice President, Council of UC Faculty Associations

glantz@medicine.ucsf.edu

Eric Hays

Director of Research, Council of UC Faculty Associations

info@cucfa.org

(October 3, 2011)

Council of UC Faculty Associations

15 Shattuck Square, #200

Berkeley, CA 94704

Phone: (800) 431-3348

EXECUTIVE SUMMARY

It is widely recognized that large reductions in state funding and sizeable increases in student fees have eroded quality and accessibility in California’s three-segment system of public higher education: the University of California, California State University and California Community Colleges. This report estimates what it would cost – through restored taxpayer funding or tuition increases — to restore the system’s historic quality while accommodating the thousands of qualified students excluded by recent budget cuts. This working paper considers state funding, student fees and accessibility to answer three basic questions about the public higher education system in California:

#1. How much would it cost taxpayers to push the “reset” button for public higher education, restoring access and quality (measured as per-student state support) while rolling back student fees to 2000-01 levels, adjusted for inflation?

Answer: It would cost taxpayers $6.671 billion. If the budget trigger is pulled in December 2011, taxpayer support for public higher education would drop by another $302 million, so the cost of the reset would rise to $6.973 billion.

#2. Absent restoration of taxpayer support for public higher education, how much more would student fees need to be increased to restore the level of per-student resources available in 2000-01?

Answer: University of California fees would have to increase over the current year’s fees by $9,230 (to a total of $22,448 per year), California State University fees would have to increase by $3,018 (to a total of $9,490 per year); California Community College fees would not have to increase. If the budget trigger is pulled, UC fees would have to increase over the current year’s fees by $9,904 (to a total of $23,122 per year), CSU fees would have to increase by $3,457 (to a total of $9,929 per year), and CCC fees would have to increase $52 (to a total of $1,132 per year).

#3. If the Governor and Legislature were to decide to push the “reset” button, — reinstating the quality and accessibility standards of the Master Plan by returning state support and student fees to 2000-01 levels, adjusted for inflation — what would it cost the typical California taxpayer?

Answer: It would cost the median California taxpayer about $49, about $51 if the budget trigger has been pulled.

Introduction

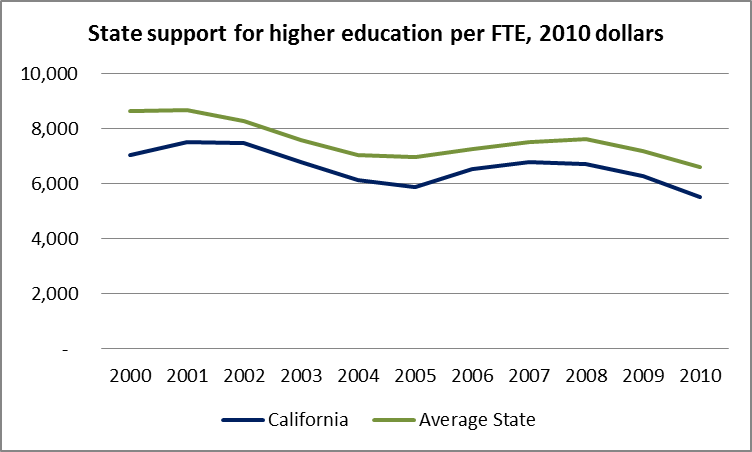

It is widely recognized that beginning with Governor Gray Davis’ 2001-2 budget year, accelerating with Governor Arnold Schwarzenegger’s Compact for Higher Education,[1] and now accelerating even further under Governor Jerry Brown’s budget, higher education in California has suffered large reductions in state funding. These reductions have effectively abandoned the California Master Plan for Higher Education[2] promise of high quality, low cost public higher education for all through an articulated system consisting of the University of California, California State University and California Community Colleges. California has consistently spent less than most states per higher education student, and public higher education funding has fallen as quickly in California in recent years as in the United States as a whole (Figure 1).

Data: State Higher Education Executive Officers, http://www.sheeo.org/finance/shef-home.htm

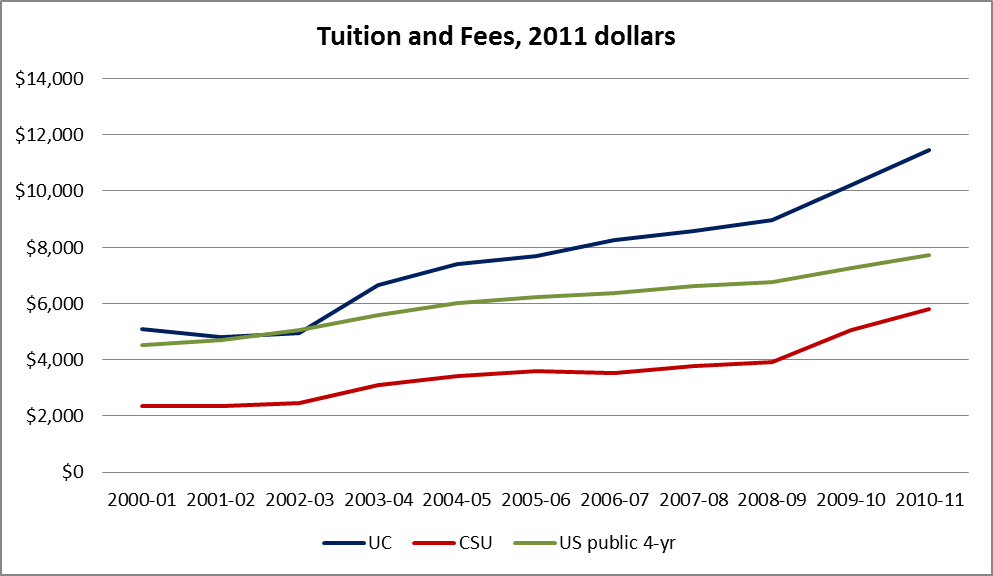

At the same time, fees at UC and CSU have increased much faster than at colleges in the US as a whole (Figure 2). While these fee increases have generally been framed as responses to the State’s immediate budgetary problems, they are also congruent with the explicit public policy choice, based on free market principles and embodied in Governor Schwarzenegger’s Compact for Higher Education, to shift higher education from a public good provided by society as a whole through taxation to being a private good purchased through user fees.

Source: College Board, table 4a of http://trends.collegeboard.org/college_pricing/

This shift in public policy is stated in the 2004 Compact on Higher Education between Governor Schwarzenegger and the UC President and CSU Chancellor: “In order to help maintain quality and enhance academic and research programs, UC will continue to seek additional private resources and maximize other fund sources available to the University to support basic programs. CSU will do the same in order to enhance the quality of its academic programs.” Until this point, the state was the primary source of support for “basic programs” with private sources being used for additional initiatives.

This working paper ties together the three elements of change: drops in state funding, fee increases, and declines in quality (measured as per student expenditures). It takes as its base year 2000-01, the last year that higher education was reasonably financially intact before the recent large fee increases. This paper addresses three questions:

- How much would it cost taxpayers to push the “reset” button for public higher education, restoring access and quality (measured as per-student state support) while rolling back student fees to 2000-01 levels, adjusted for inflation?

- Absent restoration of taxpayer support for public higher education, how much more would student fees need to be increased to restore the level of per-student resources available in 2000-01?

- If the Governor and Legislature were to decide to push the “reset” button, — reinstating the quality and accessibility standards of the Master Plan by returning state support and student fees to 2000-01 levels, adjusted for inflation — what would it cost the typical California taxpayer?

Answer No. 1: Returning quality and fees to the level of 2000-01 would cost taxpayers $6.671 billion.

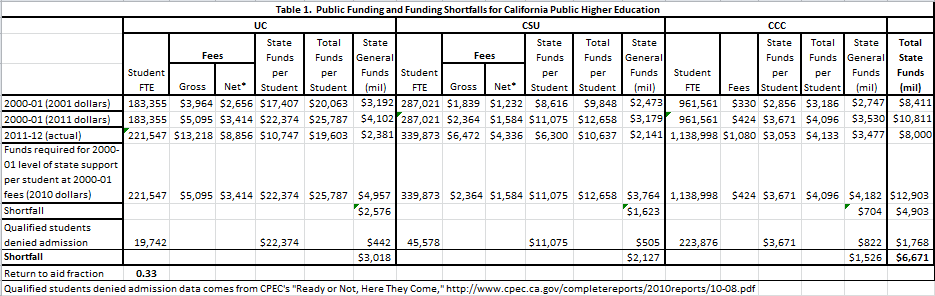

By restoring state funding to 2000-01 levels, it would be possible to return student fees to the levels of 2000-01 (adjusted for inflation) while maintaining quality (measured as total per student funding). Specifically, annual fees at UC would be rolled back to $5,095 (from $13,218), for CSU to $2,364 (from $6,472) and CCC to $424 (from $1,080).

Table 1 shows the calculations that produced this number.[3] We begin with the numbers of full time equivalent (FTE) students in each of the three sectors of California higher education and total state general funds supplied to each sector,[4] then divide one by the other to obtain the state funding per student FTE. Next we adjust the 2000-01 dollar amounts for inflation to their equivalents for 2011-12 and subtract the actual levels of funding per student currently enrolled in each sector to determine the funding shortfall compared to 2000-01.

Restoring full state funding for existing enrollments would cost a total of $4.903 billion. These calculations do not tell the whole story, however, because all three sectors have responded to resource cuts by admitting fewer students than they would under the Master Plan. Providing funding to accommodate students who have been forced out of the higher education system would raise this number to $6.671 billion.

Part of the 2011 budget deal between Governor Jerry Brown and the legislature was a promise to the state’s creditors that if, as of December 15, state tax revenue is significantly below those assumed in the budget specific cuts would be triggered. These cuts include $100 million to UC and CSU and $102 million to the CCCs.[5] Thus, if the trigger gets pulled, the cost to restore higher education funding to 2000-01 levels would be $6.973 billion.

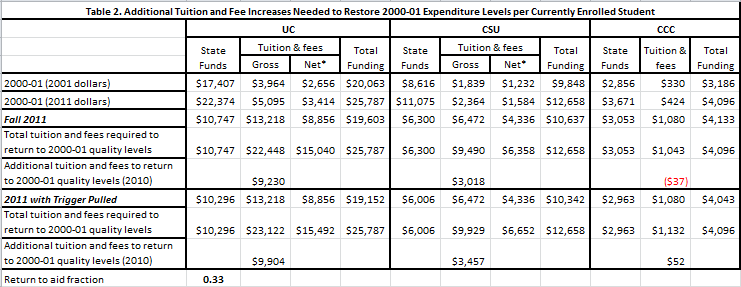

Answer No. 2: Restoring the public higher education system for all students only by increasing student fees would require raising UC fees an additional $9,230 (to a total of $22,448 per year), and CSU fees by $3,018 (to $9,490 per year). CCC fees would not have to increase. If the budget trigger described above gets pulled, UC fees would have to increase over the current year’s fees by $9,904 (to a total of $23,122 per year), CSU fees would have to increase by $3,457 (to a total of $9,929 per year), and CCC fees would need to increase $52 (to a total of $1,132 per year).

Table 2 outlines the calculations that led to these numbers. The overall approach is the same as in Table 1, except that rather than restoring per student total expenditures by increasing state support, it is done by increasing student fees. Calculations for UC and CSU assume that it continues its “high fee high aid” policy of allocating 33 percent of fees to student aid.[6] The total funding per student used as a measure of quality is the sum of state funding and net tuition and fees after deleting the fee amounts returned to aid.

Answer No. 3: Restoring public higher education while returning student fees to 2000-01 levels would cost the median California taxpayer an additional $49.

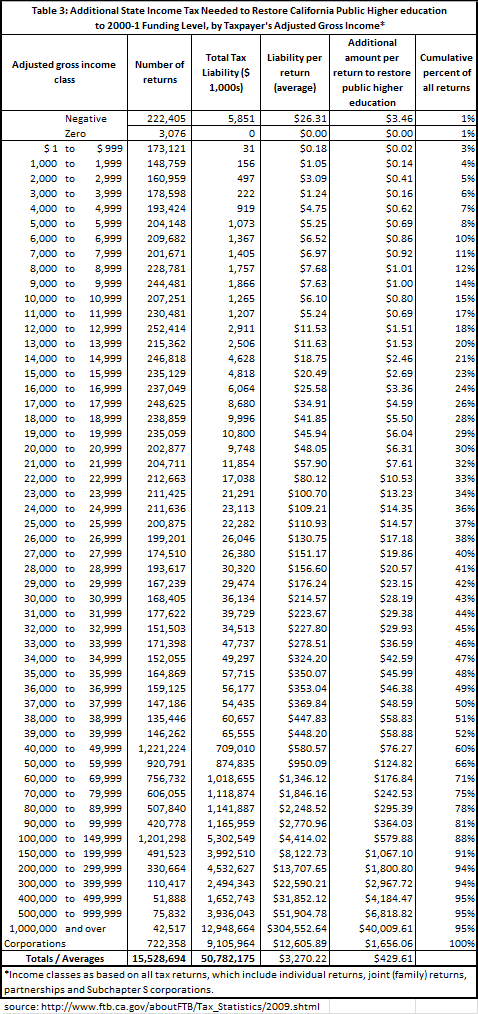

Table 3 outlines these calculations. We obtained the distribution of taxes paid by adjusted gross income per tax return from the Franchise Tax Board for 2009,[7] the most recent year available, then allocated the $6.671 billion it would cost to restore public higher education to 2000-01 proportionately across all taxpayers. Note that the categories are for tax returns, not individuals, so the results are for joint returns (families), individual returns, partnerships and Subchapter S corporations, as well as corporations that pay income taxes. Thus, the numbers per taxpayer (as opposed to tax return) for joint returns would be half the numbers in Table 3.

For the median personal income tax return, restoring California’s entire higher education system while rolling back student fees to what they were a decade ago (adjusted for inflation) would cost $49 next April 15. For the two-thirds of state tax returns with taxable incomes below $60,000, it would cost $125 or less. Tax returns with the top 5% of adjusted gross income — $400,000 to $499,999 – would increase by $4,184.

Income taxes are presented as one option, simply to illustrate the cost for typical taxpayers. Personal and corporate income taxes are only 65 percent[8] of all state revenues; part of the $6.671 billion could be allocated to other taxes, which would lower the effect on individual income tax payers. We also assume that the costs would be distributed uniformly across all tax categories. If the cost were allocated more or less progressively, that would also affect impact on individual taxpayers.

Limitations

The calculations outlined in this working paper are all based on publicly available numbers and do not benefit from models of enrollment dynamics that may be maintained by state agencies or the three segments of the California public higher education system. The estimates do not account for price elasticity: as tuition and fees increase, some students decide not to attend public higher education in California, which will reduce student demand. We assume, based on public statements and documents, that enrollment at California’s public higher education institutions has been constrained by their budgets. Finally, the distribution of taxes is based on 2009, the most recent time for which data are available; this distribution will be slightly different in 2011.

These calculations will be updated and subsequent versions of this Working Paper will be released as better data become available. This paper is an update of the paper we published in 2010.

[1] The full text of the Compact is at http://budget.ucop.edu/2005-11compactagreement.pdf.

[2] The full text of the Master Plan is at http://www.ucop.edu/acadinit/mastplan/MasterPlan1960.pdf. For a discussion of the history and current status of the Master Plan, see Legislative Analyst Office, “The Master Plan at 50: Assessing California’s Vision for Higher Education,” November, 2009, available at http://www.lao.ca.gov/laoapp/PubDetails.aspx?id=2141.

[3] The spreadsheet used to obtain all the results in this working paper is available at https://keepcaliforniaspromise.org/2066/restore2011-12

[4] Student FTE data comes from the individual higher education systems, state expenditure data comes from the Legislative Analyst’s Office available at http://lao.ca.gov/sections/econ_fiscal/Historical_Expenditures_Pivot.xls.

[5] Trigger information is available online at http://blogs.sacbee.com/capitolalertlatest/2011/06/full-details-on-the-trigger-me.html

[6] See page 16 of http://www.assembly.ca.gov/acs/committee/c2/hearing/2005/april%2020%20%202005-uc%20csu-%20public-%20cm.doc.

[7]State income tax revenue by adjusted gross income class and state income tax revenue from corporations: http://www.ftb.ca.gov/aboutFTB/Tax_Statistics/2009.shtml

[8] Governor’s Budget Revenue Estimates: http://www.ebudget.ca.gov/pdf/BudgetSummary/RevenueEstimates.pdf .

[…] Do you know that this model generates astronomical student debt and that it disproportionally affects working class students and students of color? In this regard, Bob Meister, a Professor of UC Santa Cruz, writes that, “the price of public higher education has been growing at twice the rate of the economy, twice as fast as health insurance, and three to four times more quickly than consumer prices in general. University leaders were, of course, both observers of this bubble and participants in it” (Debt and Taxes: Can the Financial Industry Save Public Universities? Privatization Is Now the Problem—Not the Solution). Are you going to participate in the expansion and consolidation of the student debt bubble or will you make a firm commitment to consider other options? It is simply not true that you have no option but to raise tuition. There are many proposals like UCSF Professor Stan Glantz’s. According to Glantz it would cost the median California tax payer between $45 and $51 to roll back UC tuition to the levels of the year 2000 (See the complete proposal https://keepcaliforniaspromise.org/2066/restore2011-12). […]

[…] Keep California’s Promise […]